Ideal Credit Union in Cheyenne Wyoming: Top Quality Banking You Can Trust Fund

Cooperative Credit Union: Your Entrance to Financial Well-Being

Credit scores unions have actually emerged as an important avenue to economic security, using a host of benefits that standard financial institutions may not provide. From customized interest to competitive prices, they provide to the private needs of their members, promoting a feeling of community and trust fund that is commonly lacking in bigger economic institutions. The question remains: exactly how do cooperative credit union attain this special balance of tailored service and financial advantages, and what establishes them apart in the realm of monetary well-being?

Benefits of Joining a Credit Scores Union

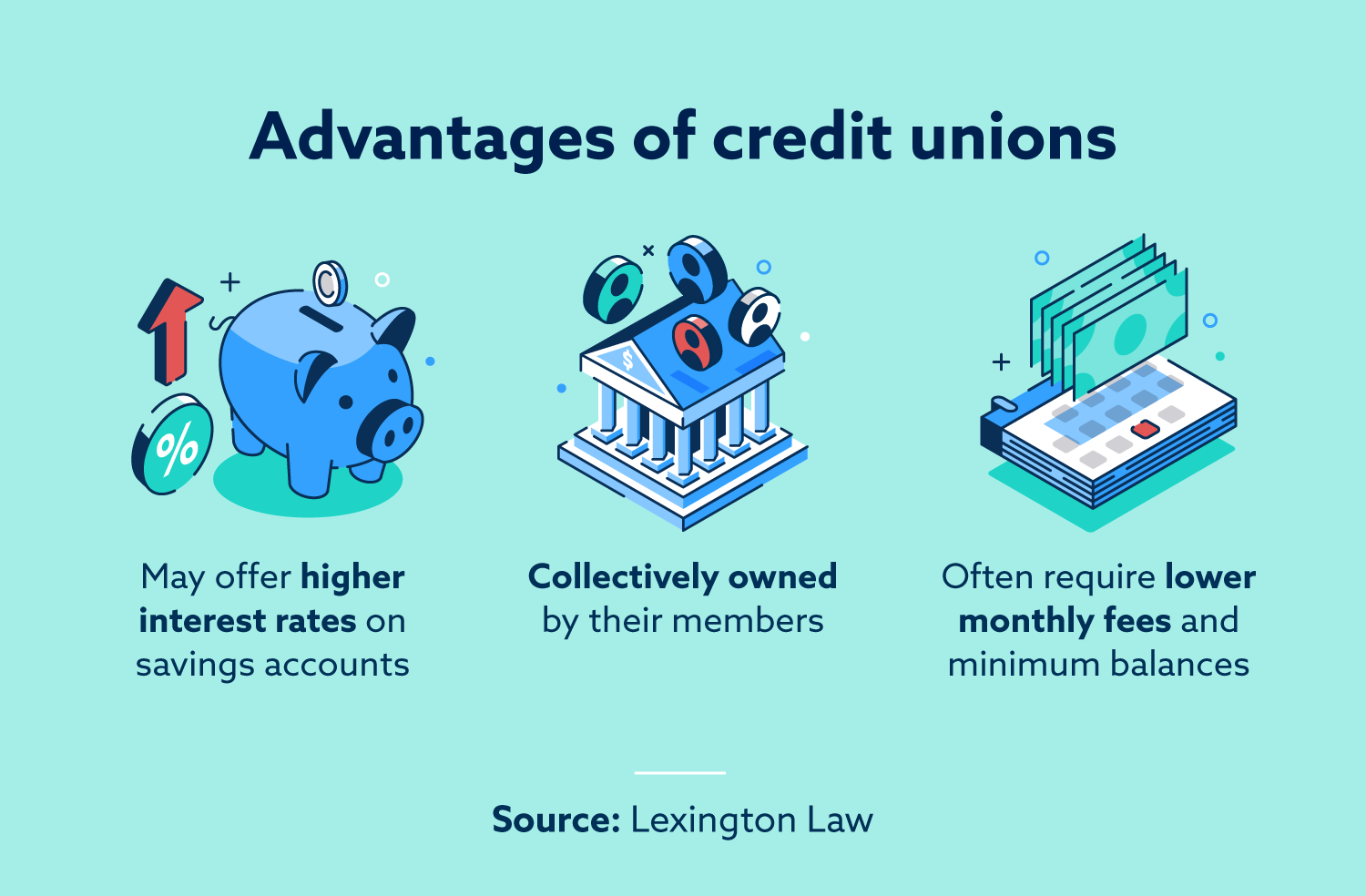

Additionally, by signing up with a credit history union, people end up being component of a neighborhood that shares similar economic goals and worths. By lining up with a credit union, individuals not just boost their own economic well-being however additionally contribute to the financial development and prosperity of their neighborhood.

Personalized Financial Solutions

When seeking customized monetary services, members of cooperative credit union can profit from customized guidance and solutions designed to fulfill their special needs and goals. Cooperative credit union prioritize understanding their members' financial circumstances, objectives, and restraints to offer tailored solutions that standard banks may not provide. This tailored approach allows cooperative credit union participants to access a variety of financial services and products that cater especially to their individual conditions.

Cooperative credit union provide individualized financial remedies such as personalized budgeting plans, investment techniques, and finance choices tailored to members' credit report and financial histories. By working carefully with their members, lending institution can use guidance on just how to improve credit history, conserve for particular goals, or browse monetary obstacles. Furthermore, credit history unions frequently offer monetary education resources to equip participants to make educated choices about their finance. Generally, the personalized touch provided by lending institution can aid participants accomplish their economic objectives successfully and successfully (Wyoming Credit Unions).

Reduced Charges and Affordable Prices

In the realm of economic services, cooperative credit union set themselves apart by using participants reduced charges and competitive prices contrasted to standard financial establishments. Among the essential advantages of credit unions is their not-for-profit framework, which enables them to focus on the monetary wellness of their participants over optimizing profits. Therefore, lending institution can offer reduced charges on services such as inspecting accounts, interest-bearing accounts, and fundings. This cost framework can bring about substantial cost financial savings for participants over time, especially when compared to the charge timetables of numerous conventional banks.

Additionally, lending institution typically provide much more affordable rates of interest on savings accounts, deposit slips, and lendings. By preserving lower operating expenses and focusing on serving their members, credit scores unions can hand down the advantages in the form of greater interest rates on cost savings and lower passion prices on fundings. This can assist members grow their savings faster and pay much less in passion when borrowing money, eventually adding to their total monetary health.

Neighborhood Focus and Customer Service

With a strong emphasis on community emphasis and outstanding consumer service, click to read credit report unions identify themselves in the monetary services sector. Unlike conventional financial institutions, credit unions prioritize developing solid partnerships within the areas they offer. This community-centric method allows credit scores unions to better recognize the distinct financial demands of their participants and customize their services appropriately.

Customer care is a leading concern for cooperative credit union, as they make every effort to provide customized help to every participant. By providing a much more human-centered technique to financial, lending institution produce an inviting and helpful environment for their members. Whether it's assisting a participant with a finance application or providing economic suggestions, credit score union team are known for their mindful and caring service.

Achieving Financial Goals

One method cooperative credit union sustain members in accomplishing their financial objectives is by providing economic education and learning and sources. With workshops, workshops, and Full Article individually consultations, lending content institution personnel give important insights on budgeting, saving, investing, and taking care of financial debt. By outfitting members with the required knowledge and skills, lending institution equip people to make informed financial choices that line up with their objectives.

Furthermore, cooperative credit union use a broad range of monetary product or services to assist participants reach their particular goals. Whether it's obtaining a home loan, setting up a retirement account, or starting a college fund, lending institution supply tailored services that provide to participants' special demands. By functioning closely with each member, credit score unions guarantee that the economic product or services suggested are in line with their temporary and lasting economic goals.

Verdict

Finally, credit rating unions provide an entrance to financial well-being with personalized focus, tailored economic options, reduced costs, and competitive rates. As member-owned cooperatives, they focus on the demands of their members and give far better rate of interest on interest-bearing accounts and reduced car loan prices - Credit Union Cheyenne. With a neighborhood focus and commitment to client solution, cooperative credit union aim to comprehend their participants' unique economic scenarios and objectives, using customized advice and support to aid individuals accomplish their financial purposes

Furthermore, credit rating unions frequently offer monetary education and therapy to help participants improve their monetary literacy and make much better decisions concerning their cash management.

Credit report unions provide customized economic services such as customized budgeting plans, financial investment approaches, and finance choices tailored to participants' credit score ratings and financial histories. Wyoming Credit.One method credit history unions support members in achieving their economic objectives is by using economic education and learning and sources. By functioning carefully with each member, debt unions make sure that the economic items and services advised are in line with their long-term and temporary economic objectives

With an area emphasis and commitment to client solution, credit score unions make every effort to comprehend their participants' unique financial scenarios and objectives, providing customized assistance and assistance to assist individuals attain their financial purposes.